Table of Contents

Introduction

How to deactivate Paytm FASTag: In recent developments, the Reserve Bank of India (RBI) has imposed restrictions on Paytm Payments Bank, affecting various services, including FASTag. If you’re a Paytm FASTag user, it’s essential to understand the new regulations and learn how to smoothly close your Paytm FASTag account. In this comprehensive guide, we’ll cover the recent regulatory actions, the steps how to deactivate Paytm FASTag, and alternatives to ensure uninterrupted access to digital financial services.

Recent Regulatory Actions: Understanding the RBI Restrictions

As of February 29, 2024, the RBI has restricted Paytm Payments Bank from accepting new deposits, top-ups, and offering certain services, including FASTag. The central bank’s concerns primarily revolve around compliance with Know Your Customer (KYC) norms and IT-related issues.

- No Deposits or Top-ups After February 29, 2024:

- Paytm Payments Bank will no longer accept new deposits or top-ups for any customer accounts, including FASTag.

- Existing FASTag balances can still be used for toll payments until the balance is exhausted.

2. Alternative Options and Withdrawal:

- Users won’t be able to recharge or top-up their Paytm FASTag after the specified date.

- Consider obtaining a new FASTag from another bank to avoid inconvenience.

3. Closure of Other Services:

- Paytm app and UPI payments remain unaffected, allowing users to continue transactions.

- Plan ahead if you have salary credits or other direct benefit transfers linked to your Paytm Payments Bank account.

How to Deactivate Paytm FASTag

Follow these steps carefully to ensure a smooth deactivation process:

How to Deactivate Paytm FASTag through the Paytm App:

- Open the Paytm App:

- Start by launching the Paytm app on your mobile device.

- Navigate to Your Profile:

- Tap on the profile icon located in the top-left corner of the app interface.

- Select “Help & Support”:

- In the profile section, locate and choose the “Help & Support” option.

- Access FASTag Deactivation:

- Under the “Banking Services & Payments” category, find and select the FASTag option.

- Initiate Deactivation Request:

- Scroll down and look for the “Chat with us” option at the bottom.

- Use this feature to raise the deactivation request with Paytm’s customer support.

How to Deactivate Paytm FASTag from the Paytm Portal:

- Log in to Your Paytm Account:

- Visit the Paytm website and log in using your registered mobile number.

- Navigate to “Manage FASTag”:

- Click on “Manage FASTag” followed by “Travel Services” within the Paytm portal.

- Select the FASTag Account:

- Review all your active FASTag accounts linked to your Paytm wallet.

- Choose “Close FASTag”:

- Select the specific FASTag account that you want to close and choose the option “Close FASTag.”

Exploring Alternatives: Ensuring Seamless Financial Transactions

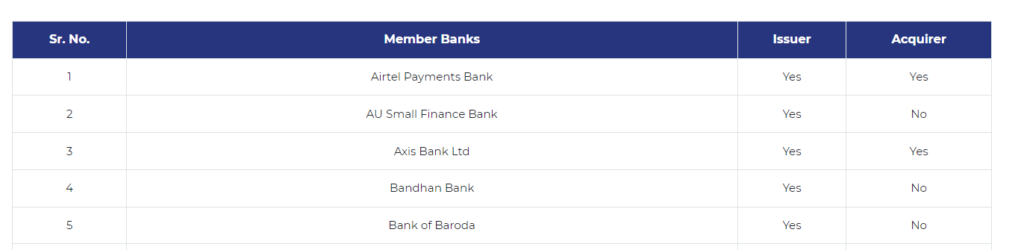

List of top 5 FASTag live members:

Given the recent regulatory actions, it’s prudent to explore alternative financial services to meet your needs. Here are some options to consider:

Other Digital Wallets:

- Explore wallets like PhonePe, Google Pay, or Amazon Pay for similar services.

- PhonePe and Google Pay support UPI transactions for versatility.

Traditional Banks:

- Consider using services from traditional banks with mobile apps for managing accounts and transfers.

- Look for banks offering zero-balance savings accounts for minimal maintenance requirements.

Other FASTag Providers:

- Since Paytm FASTag services are discontinued, explore providers like ICICI Bank, Axis Bank, or HDFC Bank.

- Ensure the chosen provider has a broad network of toll plazas for convenient travel.

Physical Debit/Credit Cards:

- If you relied on Paytm Postpaid, apply for physical debit or credit cards for online and offline transactions.

Direct Bank Transfers:

- Use NEFT/IMPS for fund transfers between accounts through mobile apps or internet banking.

Explore Local Services:

- Depending on your location, explore local payment services or wallets catering to specific regions.

Conclusion: Navigating Change with Confidence

The recent changes in Paytm Payments Bank’s services, including FASTag, necessitate proactive steps for users. By following the deactivation process and exploring alternative financial services, users can ensure uninterrupted access to digital transactions.

As the financial landscape evolves, staying informed and adaptable is key. The regulatory actions by the RBI are aimed at strengthening the banking sector and protecting depositors’ interests. Embrace the transition with confidence, explore new opportunities, and continue to enjoy the benefits of digital financial services. Stay updated with official communications to stay ahead in this dynamic financial environment.

For more such latest and interesting articles keep visiting The Fusion Fables.